Financial trading has become very popular over the past few years. The Forex Factory is just the foreign exchange market, or basically how traders check finances from all over the globe. It features the previous, the actual and also some predictions about whether the finances will increase or decrease over the whole day. The market trades 24 hours a day, 5 days a week. So there is a lot of different ways trading could work out for you seeing as it’s an all day thing. Continue reading

Tag Archives: Japan

Using VIX in Exposing Complacency

Using VIX in Exposing Complacency

While much has been said about the efficacy of the VIX to expose rising fear in the market, the index also deserves at least the same amount of ink spilled for its ability to expose rising risk appetite, sometimes also known as rising complacency. The chart illustrates how the most prolonged periods of relatively low volatility coincided with a phase of rising equities, characterized by rising bullishness and heightened investor confidence in the stock market. These phases are prominently identifiable in August 1998, January 1999 through February 2000, and Continue reading

While much has been said about the efficacy of the VIX to expose rising fear in the market, the index also deserves at least the same amount of ink spilled for its ability to expose rising risk appetite, sometimes also known as rising complacency. The chart illustrates how the most prolonged periods of relatively low volatility coincided with a phase of rising equities, characterized by rising bullishness and heightened investor confidence in the stock market. These phases are prominently identifiable in August 1998, January 1999 through February 2000, and Continue reading

WORLD INTERVENES AGAINST STRONG DOLLAR (1985–1987)

WORLD INTERVENES AGAINST STRONG DOLLAR (1985–1987)

The excessive strength of the U.S. dollar proved detrimental to the world economy. The U.S. trade gap moved sharply into a deficit and millions of manufacturing jobs were lost. Sharp depreciations in the currencies of the

The excessive strength of the U.S. dollar proved detrimental to the world economy. The U.S. trade gap moved sharply into a deficit and millions of manufacturing jobs were lost. Sharp depreciations in the currencies of the

United States’ trading partners triggered surging inflation that required central banks to tighten aggressively, sending their economies into recessions. Continue reading

The First Dollar Crisis (1977–1979)

The First Dollar Crisis (1977–1979)

The U.S. dollar rebound of the mid-1970s came to a halt in summer 1976. What followed in the second half of the decade would be a five-year decline in the currency, unprecedented in the new post–gold standard era. [ad code = 3]

The U.S. dollar rebound of the mid-1970s came to a halt in summer 1976. What followed in the second half of the decade would be a five-year decline in the currency, unprecedented in the new post–gold standard era. [ad code = 3]

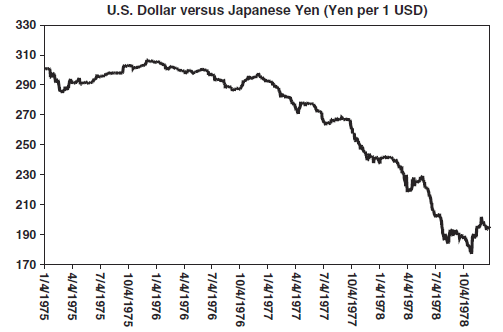

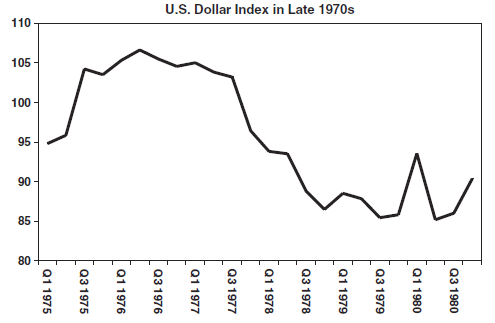

Jimmy Carter’s presidential campaign against Gerald Ford sought to lift the U.S. economy from its slowdown in the second half of 1976. Carter’s currency policy was famously based on the talking down of the U.S. dollar, especially through his outspoken Treasury Secretary Michael Blumenthal, who pressured the Fed into monetary policy easing. The slide was accelerated in June 1977 when Blumenthal talked down the dollar after a meeting with his German and Japanese counterparts. The new policy sent the dollar tumbling more than 20 percent between January 1977 and October 1978, a dramatic plunge by postwar standards. The chart shows how the dollar tumbled 38 percent against the Japanese yen as Japan’s trade surplus soared on its burgeoning exports industry. The chart illustrates the 22 percent decline in the U.S. dollar index from its 1976 peak.

The dollar crisis was a vociferous manifestation of eroding market confidence in Carter’s economic policies despite the fact that U.S. interest rates were yielding substantially more than those overseas. While the

United States had embarked on a gradual tightening policy starting in early 1977, Germany and Japan were in the midst of an easing campaign that lasted well into 1978. From summer 1977 to autumn 1978, U.S. interest rates nearly doubled from 5.9 percent to 9.5 percent. In contrast, German and Japanese rates fell from 4.5 to 3.5 percent and from 5 to 3.5 percent, respectively, tripling the yield advantage in favor of the U.S. dollar. So why did the dollar damage occur when the U.S. currency had yielded substantially higher rates than its German and Japanese counterparts?

The answer lies in Carter’s policy of targeting a 4.9 percent unemployment rate, following the stagflation days of the Ford administration where unemployment breached 9 percent and inflation crossed over 11 percent.

As Carter pursued his unemployment target via major fiscal stimuli, inflation headed back up and so did the budget deficit—the two bogeymen of financial markets. Inevitably, confidence in the dollar continued to erode.

In November 1978, the United States mounted a massive joint intervention with Germany and Japan to buy dollars against foreign currencies. The move was supplemented with a 100-basis-point increase in the discount rate, the biggest in 45 years. The coordinated intervention proved limited in stabilizing the U.S. dollar. It wasn’t until the Fed rewrote the rules of monetary policy management to combat soaring inflation in late 1978 that the currency began to turn around.